AI-Powered Investigations

CRIMR empowers organizations to report, store, and resolve millions of incidents with AI-driven speed, clarity, and cross-functional precision—on one powerful, unified platform.

One Platform. Every Channel. Zero Compromises.

Stop duct‑taping disparate tools together. CRIMR is the only founder‑led, AI‑first investigations solution that unifies every incident channel—POS, e‑commerce, HR, mobile tip lines, and more—into a single command center.

Why True Omni‑Channel Matters

Modern fraud and misconduct thrive in the gaps between your systems and teams. When channels aren’t unified, every handoff erodes visibility—and every blind spot becomes an opportunity for loss.

Consider these real‑world scenarios:

-

A coordinated ring steals high‑value items in your flagship store, then returns them online for full refunds.

Your LP team sees the shrink rate rising. Your e‑commerce team flags an uptick in refund claims. But without a unified view, these patterns live in separate silos—until it’s too late.tion text goes here

-

A supervisor is caught altering sales records to mask internal shrink. HR logs the complaint. Legal opens a hold. Compliance launches an audit.

Three teams, three systems, three case numbers—but none of them talk to each other. By the time you manually reconcile entries, evidence trails have gone cold.

-

A tip line submission on a mobile app reveals suspicious activity at a remote outlet. That tip correlates to known Organized Retail Crime (ORC) suspects.

Legacy platforms force you to export the tip, email it to LP, and hand‑enter suspect IDs—while the criminals stay one step ahead.

Stream every incident feed—from POS terminals and e‑commerce platforms to HR systems,

mobile tip lines, and CCTV logs—into one live, unfiltered data lake.

Our patent‑pending AI analyzes millions of records per second, auto‑linking related events

across channels and departments—so you see the full story the moment it unfolds.

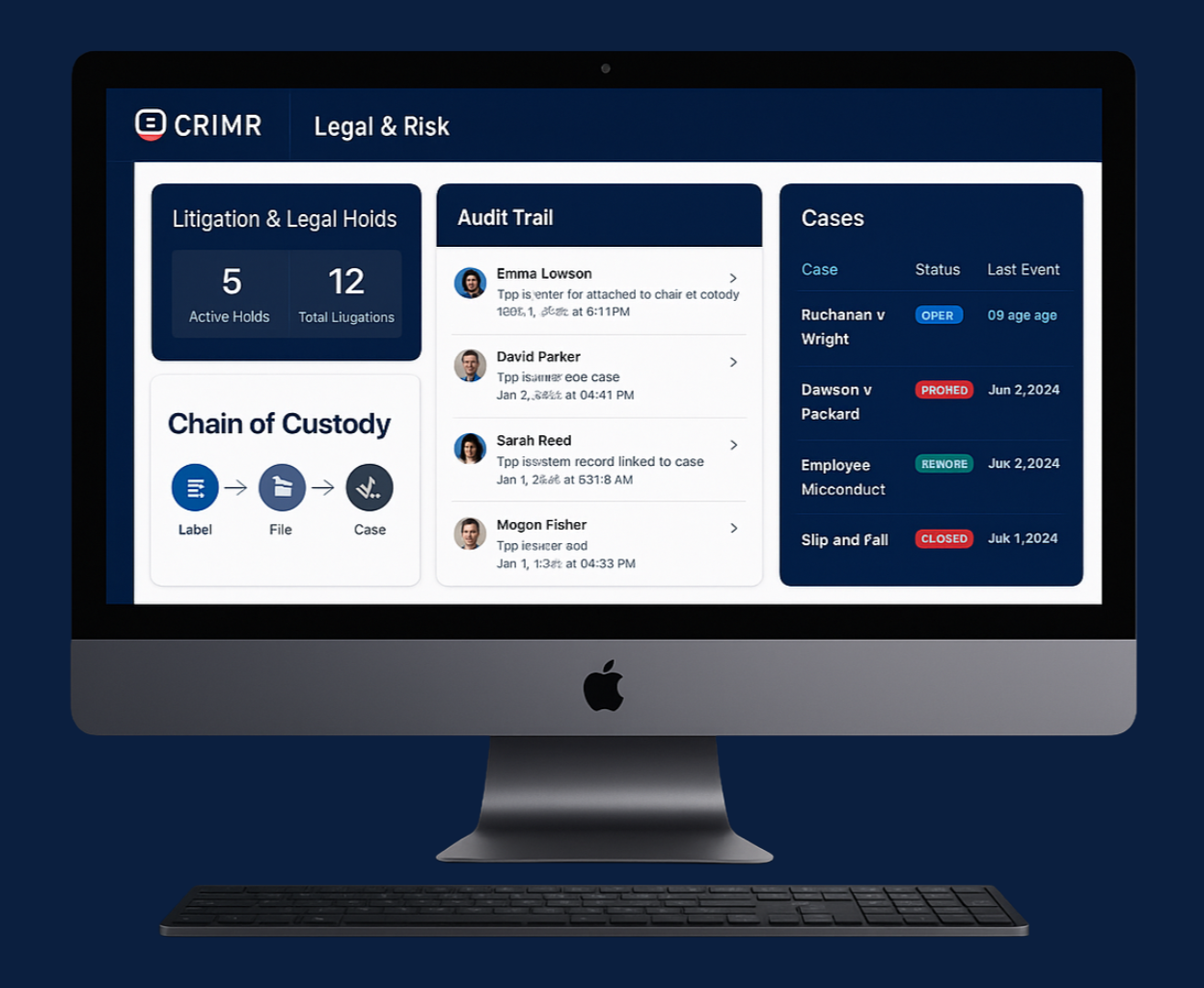

One platform, one case. Route investigations from Loss Prevention to Legal to HR in a

single click—complete with tamper‑proof audit trails and export‑ready packets.

Dynamic dashboards surface emerging fraud patterns, repeat offenders, and compliance gaps—

no more hunting through scattered reports or wrestling with exports.

CRIMR’s Answer: Real‑Time, End‑to‑End Investigation Intelligence

Unified Data Ingestion

Instant Correlation & Crime‑Linking

Seamless Cross‑Team Workflows

360° Risk Visibility

Unmatched AI Crime‑Linking Intelligence

CRIMR’s patent‑pending AI engine doesn’t just find incidents—it connects the dots across your entire organization faster and more accurately than any other solution on the market.

-

Instantly link in‑store theft, e‑commerce scams, HR complaints, mobile tips, CCTV evidence, and third‑party data in one unified graph.

-

Surface repeat offenders, collusion rings, and emerging M.O. trends before losses escalate.

-

As new incident data streams in, CRIMR’s AI recalculates connections on the fly—so you never miss a critical lead.

With AI‑driven linking and automated routing, investigations move at lightning pace. Unified visibility and predictive alerts stop coordinated schemes early. True plug‑and‑play connectors eliminate expensive dev work and delays. Let CRIMR’s AI handle link detection so your team focuses on real risk mitigation.

💼 Tangible ROI & Business Impact

50% Faster Case Resolution

30% Cut in Fraud Losses

70% Lower Integration Costs

80% Time Reclaimed

Legacy “AI” platforms force you to build your own models or sell you generic bolt‑ons that can’t keep up with real‑world ORC, refund fraud, and insider collusion.

CRIMR’s engine was designed by investigators for investigators—delivering unmatched precision and speed.

🏆 Why CRIMR Blows Past the Competition

Capability

CRIMR AI‑Linking

Legacy Vendors

Bolt‑On ML Add‑Ons

Native Crime‑Linking AI

Built in from day one

None or rule‑based only

Tacked‑on, low accuracy

Patent‑Protected Engine

Exclusive network‑linking tech

No patents

No proprietary IP

Instant Cross‑Silo Views

One platform, every channel

Multiple disconnected tools

Partial, slow data sync

Continuous Self‑Learning

Adapts to new fraud patterns

Static rule sets

Limited retraining cycles

Founder‑Led Innovation

Expert‑driven roadmap

VC/PE profit roadmaps

Innovation lag